BLOOMBERG HEADLINE 17 Nov 2021 | Biden Urges FTC to Probe Gasoline Market With Prices Up 50% “In a letter to Wednesday to FTC Chair Lina Khan, the president expressed concern about the difference between pump prices and the cost of wholesale fuel, while citing what he said was “mounting evidence of anti-consumer behavior by oil and gas companies.”

REASON NEWS STORY 15 June 2022 | Instead of Helping Americans Battle Rising Prices, Biden Escalates ‘Big Oil’ Blame Game “There’s widespread agreement among economists that higher profits are not what’s driving inflation—something even Treasury Secretary Janet Yellen acknowledged last week. Biden blaming “Big Oil” for inflation in gas prices makes as much sense as Sen. Elizabeth Warren (D–Mass.) blaming grocery stores for higher food prices.“

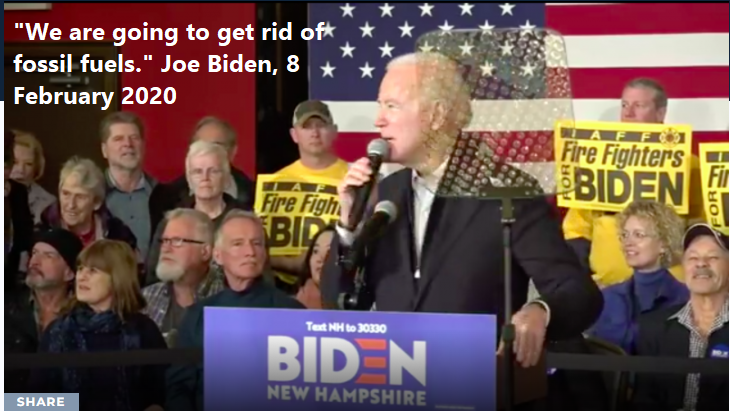

What factors affect the prices of motor fuels in America? Let’s learn macroeconomics from Khan Academy, a video posted on YouTube 10 years ago. If you bump into Joe Biden at the Delaware beach, please share this with him.

These producers, they invest huge amounts of money in exploration and then in drilling. They make some assumptions. They say, “Hey, this oil rig that I’m going to spend a hundred or two hundred million dollars on, this is going to be break-even if oil prices are said [to be] $30 a barrel. “Obviously, if oil prices end up being at $100 a barrel, they’re going to make a killing. They’re going to make $70 per barrel of profit. This thing is going to produce millions and millions of barrels. On the other hand, if oil prices go down to $15 per barrel, they’re going to be killed. They’re going to take a huge loss on this huge investment they made. Text excerpt from the above video, minute markers, 1:53-2:25

Investors make investment decisions on the payout of a potential investment. How long does it take for an oil well to pay back investors? I quote from Investopedia.com: “One study found the world’s largest oil and gas fields averaged 5.5 years from discovery to the first production and took 17 years of production on average to reach peak output.10 Chevron Corporation’s (CVX) Gorgon natural gas development project off the coast of Australia took 30 years to progress from discovery to construction and nearly six more years to start producing liquefied natural gas.11“

This month of June, the Washington Examiner reports, “President Joe Biden has a stated goal of cutting economywide emissions 50%-52% by 2030 by reducing the use of fossil fuels and promoting green energy sources such as wind and solar. He also wants to see half of all new vehicles sold running solely on electricity by that date [2030].”

I ask. If you knew your investments would pay out, at best, after 5.5 years, or most likely after 10 years, would you invest in oil and gas, knowing that natural fuels will be outlawed before you could reap a reasonable return on your investment?

No, you would not and the people who invest in oil would not, either.

Tell your congressional delegation to demand Joe Biden remove his obstacles that stand in the way of oil companies, investors, drillers, pipeline companies, road constructors, refiners, fuel delivery companies, and fuel retailers producing abundant and inexpensive motor fuels.

John White

Rockwall, Texas