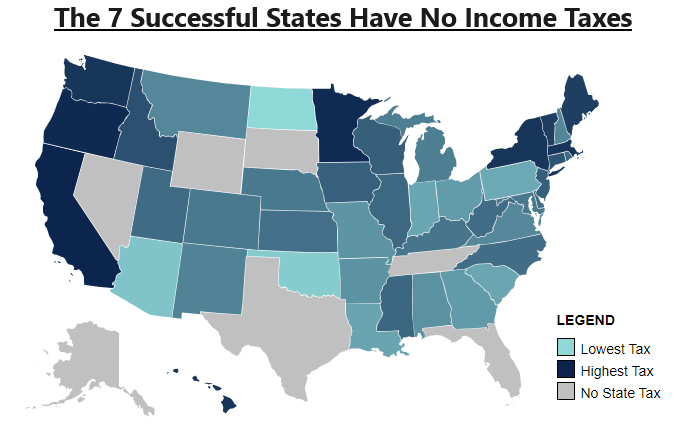

Thankfully, the great State of Texas has no individual income tax. Click on the image to learn how the 7 successful states have zero income taxes.

Four states in which I lived and worked or worked away from home include Connecticut (5.7%), North Carolina (4.75%), Oklahoma (2.33%), and New Mexico (4.08%).

The Tax Poem — Source: The Adam Smith Institute

Tax his land, Tax his bed, Tax the table at which he’s fed.

Tax his tractor, Tax his mule, Teach him taxes are the rule.

Tax his work, Tax his pay, He works for peanuts anyway!

Tax his cow, Tax his goat, Tax his pants, Tax his coat.

Tax his ties, Tax his shirt, Tax his work, Tax his dirt.

Tax his tobacco, Tax his drink, Tax him if he tries to think.

Tax his cigars, Tax his beers, If he cries tax his tears.

Tax his car, Tax his gas, Find other ways to tax his ass.

Tax all he has, Then let him know, That you won’t be done till he has no dough.

When he screams and hollers, Then tax him some more, Tax him till he’s good and sore.

Then tax his coffin, Tax his grave, Tax the sod in which he’s laid.

Put these words Upon his tomb, ‘Taxes drove me to my doom…’

When he’s gone, Do not relax, Its time to apply the inheritance tax

The Federal Capitation Tax (aka Income Tax)

In the post-Civil War era, two amendments, the 13th and the 14th, served to equalize the benefits and privileges among all our people. Perhaps the most consequential and just clause is this: Amendment XIV, Section 1:

All persons born or naturalized in the United States, and subject to the jurisdiction thereof, are citizens of the United States and of the State wherein they reside. No State shall make or enforce any law which shall abridge the privileges or immunities of citizens of the United States; nor shall any State deprive any person of life, liberty, or property, without due process of law; nor deny to any person within its jurisdiction the equal protection of the laws.

Remember this phrase: ‘the equal protection of the laws’

Capital Gains Taxes, Realized and Unrealized

The following short video explains capital gains, realized, and unrealized (losses) from investments.

What are unrealized capital gains? The following brief video explains unrealized capital gains.

The latest unconstitutional proposal by members of Congress is to tax unrealized capital gains. To learn more on this subject, read Killing growth—why the Unrealized Gains Tax spells disaster for the economy

Has there ever been an income tax in world history that was truly equitable, upholding the right of the equal protection of the laws? Yes, read about it: God’s Tax: Equal Protection of the Laws

Money

Gold is money. I have a GLINT account (https://glintpay.com/). I buy allocated gold with my US dollars. The gold is stored in a Brinks vault in Switzerland and is insured by Lloyds of London. Glint issues a MasterCard debit card with which I can purchase goods and services anywhere in our country and anywhere in the world. If the U.S. Treasury were to go flat broke, my gold money would continue to serve as a means of exchanging money for goods and services.

What is money? The WordReference.com online dictionary defines money as the coins and bills issued by a country to buy something; a medium of exchange that functions as legal tender. Another, Dictionary.com, defines money as any circulating medium of exchange, including coins, paper money, and demand deposits; gold, silver, or other metal in pieces of convenient form stamped by public authority and issued as a medium of exchange and measure of value.

Website The History of Gold As Money says, “Gold has a long history and has been used as money for several thousand years.”

“While not formally part of the money system today, central banks still hold gold, giving it a proximate shadow status in the current system.

“Of all the elements of the periodic table, gold is the one best suited for use as money. It is:

- Scarce

- Malleable

- Durable

- Portable

- Divisible

- Fungible

“The unique nature of gold’s chemical properties is why gold has been used as money and why it superseded other commodities. It was given value by the market because it functioned as money better than anything else.

“Gold’s key attribute is that it is a store of value over a long period of time. It can fluctuate in the short term but over decades, centuries and millennia, it preserves wealth.

“As the saying goes, you don’t buy gold to get rich, you buy gold to stay rich. It is a wealth preserver.“

Death By Inflation

Our Democrat-controlled Federal government subscribes to modern monetary theory (MMT). What Is Fiat Money?

“Fiat money is a government-issued currency that is not backed by a physical commodity, such as gold or silver, but rather by the government that issued it. The value of fiat money is derived from the relationship between supply and demand and the stability of the issuing government, rather than the worth of a commodity backing it.

“Most modern paper currencies are fiat currencies, including the U.S. dollar, the euro, and other major global currencies.” Investopedia.com | Fiat Money: What It Is, How It Works, Example, Pros & Cons

Why is MMT a theory? Because it has never been proven to be successful in all of human history.36

In the video below, Prof. Antony Davies explains: Modern Monetary Theory is Wrong – Here’s why

Gavyn Davies wrote for the Financial Times on April 28, 2019, “Many mainstream economists (see Paul Krugman, Lawrence Summers and Kenneth Rogoff) think that MMT is deliberately made obscure because it is nothing more than “modern monetary nonsense.” It is often described as a questionable extension, made by fringe economists, of a doctrine that may be partially true, but only in extreme circumstances. I tend to agree with that.”

Financial Times, May 19, 2024, Transcript: Has the US finally borrowed too much?

The US Dollar has been the world’s reserve currency for many years. Today? Former purchasers of US treasuries are realigning with BRICS and turning away from petrodollars.

The Situation With My GLINT gold?

Gold preserves wealth under our present confiscatory federal income tax system. As the dollar inflates, the dollar price of gold naturally follows upward. The problem is the capital gains tax sucks the life out of the gold. Yes, the gold remains, but actually losing due to inflation. If Joe Biden gets his way with the proposed 45% INCREASE on realized capital gains and also taxing unrealized capital gains, our economy will tank, sink, and go kaput. But, is this not what Barack Hussein Obama wanted when he said, “I want a fundamental change.“

If Joe Biden gets his way, I will sell off my gold as quickly as possible and never buy more.

Hopefully, we have enough solid Republicans in the 2025 Texas House to pass the Texas Gold-Backed Currency that would be more than a hedge against US dollar inflation; it would be immune to the ravages of MMT.

John White

Rockwall, Texas